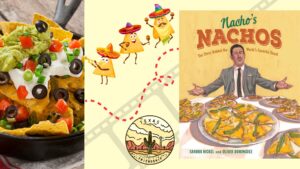

Goods and Service Taxes (GST) have been quite a thorn in our sides since the sudden increase in GST on common household products. Adding more thorns to our side is yet another ridiculous change: packaged parathas will now attract 18% GST whereas chapatis are set at 5% percent.

Gujarat Appellate Authority for Advance Ruling (GAAAR) has upheld the GAAR order in an application that was filed by Vadilal Industries. Vadilal Industries has put up an argument against the General Anti-Avoidance Rule (GAAR) in this matter.

Arguments and justifications

Firstly, GAAR is a tool used to control and avoid tax evasions and tax leaks and that also checks aggressive tax planning. According to Vaadilal, the primary ingredient in the eight types of parathas they produce remains the same: Wheat flour. Therefore, they should also draw the same rates as chapatis. They only add vegetables, such as onions and others for flavour and essence only. But GAAR argued that Parathas require a few minutes of cooking before consumption as they are not ready to eat. Whereas, rotis or chapatis on the other hand do not require cooking or processing before consumption. Holding onto this, GAAR ruled that parathas will come under the categories of items attracting 18% GST.

However, according to Vadilal GAAR made errors in their judgment as both parathas and plain rotis need to be heated before consumption. They cited the example of Pizza, which is required to be heated or cooked before consumption and draws only 5% GST.

GAAR held that the varieties of parathas produced by Vadilal have, apart from wheat flour and water, certain other ingredients such as emulsifying agents, milk, salt, vinegar, etc; which is the same in plain parathas. Rotis and chapatis are directly consumed but parathas need to be cooked and heated before consumption, which brings attention to the fact that rotis and parathas are not the same and the latter will be classified under a different section, attracting 18 % GST. This argument was held by the Gujarat Appellate Authority (GAAAR) in support of the GAAR provision.

This is not the first time that a dispute was brought forth under the GST system and has reached an AAR. As mentioned before, there have been several questions raised in the GST rates added and deducted for a set of [products, for instance, there have been issues raised over the prices of cheese balls, fried snacks, beverages, etc.

However, in this specific matter, Gujarat Appellate Authority has highlighted that the most minute principles and elements are taken into consideration when the end use of a product or a group of products are to be classified for GST taxation. Even what proportions a set ingredient is used in the product also serves as a major factor in the justification and classification.

It is important to note that the GST system classifies food items for rates and taxation on the basis of a 6-digit uniform code known as the ‘HSN code’ (Harmonized System of Nomenclature), which systematically classifies goods across the world. However, disputes were raised over how the tax rate applicable to them was determined.

–An article by Shreya Raolji